Risk & Progress| A hub for essays that explore risk, human progress, and your potential. My mission is to educate, inspire, and invest in concepts that promote a better future for all. Subscriptions are free, paid subscribers gain access to the full archive, including the Pathways of Progress essay series.

Taxes are a subject that few desire to discuss, but when the topic is broached, the discussion typically centers around the tax rate, whether it should be lower, or higher, and for whom. Usually absent from this conversation are the kinds of taxes we ought to have. With the proper tax design, however, the economy will grow faster, and prosperity spread more evenly. Armed with an understanding of the “Dark Side” of property, I argue that a Land Value Tax offers a transformational opportunity to enhance future growth and accelerate human progress.

Why Do We Have Taxes?

Modern civilization levies taxes for two basic purposes. First, to raise revenue for socially beneficial public services like roads, schools, and police. Second, we use taxes to encourage or discourage certain kinds of economic or social behavior. Taxing sugar-sweetened beverages is a good way to preserve human capital, for example, just as taxing carbon is the best means to prevent climate change. When it comes to taxation, governments have essentially three options or types of taxes at their disposal:

Taxes on what you earn (income, corporate income, business, capital gains…etc.)

Taxes on what you buy (VAT, sales, or excise) and

Taxes on what you own (property taxes)

What is important to understand here, however, is that not all taxes have an equivalent impact on the economy. Thus, to maximize growth and human opportunity, taxes should be designed with great care. Economist Adam Smith outlined the four canons of good taxation centuries ago and they hold today:

Canon of Equity: Taxes should be proportional to income.

Canon of Certainty: Taxes should be clear, not arbitrary or hidden

Canon of Convenience: They should be easy to pay (i.e. no filing fees)

Canon of Economy: They should be cheap to administer and collect

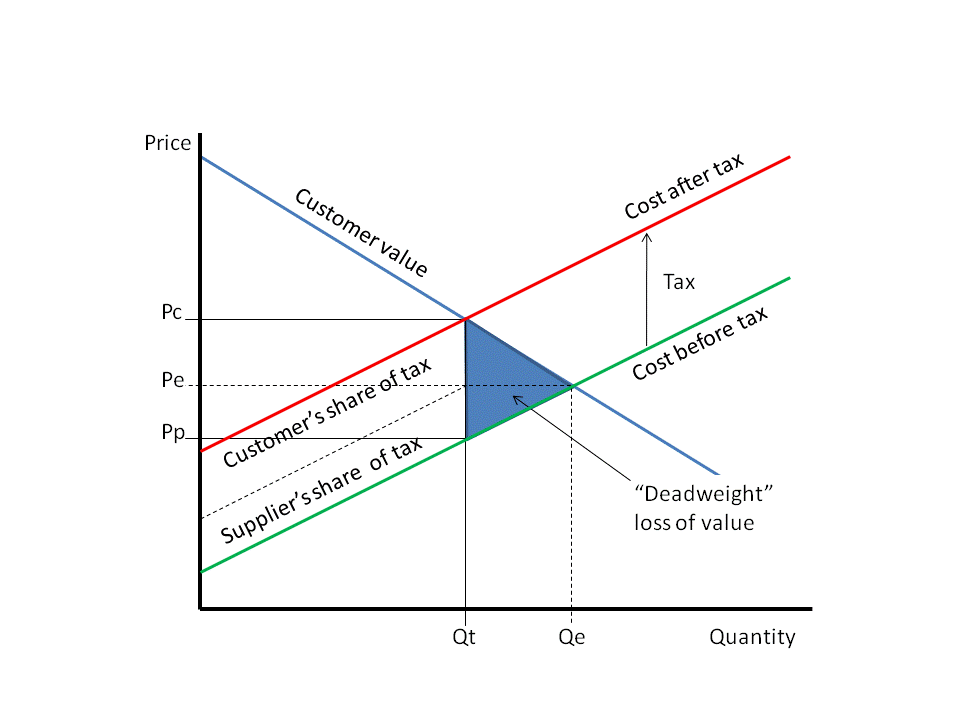

Today, we recognize a fifth canon: taxes should minimize “dead-weight loss.” Deadweight loss refers to the hidden ‘tax on the tax’ that depresses growth without raising any corresponding income. When we tax something, whether we tax chairs, cars, or incomes, we tend to get less of it, because the tax throws the supply and demand equilibrium out of balance. To the extent that a tax engenders deadweight loss, also known as “excess burden,” it generates no revenue while still slowing our problem-solving machine. Obviously, this is something we would preferably avoid.

It is important to understand that deadweight loss does not rise linearly with the tax rate, instead, it grows with the square of the rate. In other words, when we double the tax rate, we quadruple the deadweight loss. This has profound implications because it means that maximum economic efficiency and prosperity necessarily require keeping tax rates as low as possible. It also means that there is a fundamental limit to how high taxes can go before the deadweight losses shut down growth entirely. In other words, the answer to government overspending cannot always be “raise taxes.”

Tax the Land

As I noted before, however, not all taxes are equal. There is one tax that meets all five Canons of good taxation. Praised by economists from Henry George to Milton Friedman to Mason Gaffney, the Land Value Tax, or LVT, checks all of the boxes. An LVT is a tax on the “unimproved” rental value of land. In fact, some don’t consider LVT to be a true tax at all, because rather than arbitrarily extracting wealth, it’s more akin to a payment system for the use of a location; a rental fee for land use.

To understand this, imagine that you own a remote tract of land. Your land has little value because of its location. But you get lucky, a few years later the local government builds a train line and station that connects your tract to the nearby city; suddenly the value of your parcel skyrockets. You sell your land at a handsome profit. You did nothing to create or earn this value, you privately captured the fruits of a public benefit. LVT captures this surplus and redirects it to the public that created it.

If our goal is strong economic growth and human prosperity, we should stop taxing production (capital gains, incomes, corporate incomes…etc). Income taxes, for example, tax your labor, placing your precious time into government coffers; punishing the worker for working. This makes no sense. An LVT taxes only the surplus value of land, not production, not anyone’s time or labor. Land and resources (with rare exceptions) were not created by humankind; they were already there. When someone owns land, they reap the benefits of something they did not create. In economic terms, unearned “rents.” An LVT recoups the fruits of nature and society for redistribution and public benefit.

With respect to the canons of good taxation, land is disproportionately owned by the wealthy, thus an LVT is progressive. It’s a stealth wealth tax that doesn’t punish the wealthy for success but levels the playing field by eliminating the home-court advantage. Unlike wealth taxes, however, LVT is impossible to evade; land cannot be hidden or moved overseas. Like property taxes, the calculation methodology and tax rates would be public. Unlike property taxes, however, an LVT doesn’t punish development; taxes do not rise simply because developers made productive use of the land. On the contrary, in an LVT-based society, the cranes and bulldozers of progress would always be on the move because it is not rational to hold land tracts in idle speculation, as many wealthy land developers currently do, waiting for the value of land to grow.

Most importantly, however, we must remember that land supply is fixed by Mother Nature. As we saw above, when we tax something, we tend to get less of it, and this gives rise to deadweight loss. The supply of land, however, is fixed. Thus, an LVT can raise revenue with negligible (or zero) economic deadweight loss. This means we can raise revenue without negatively impacting economic growth. An LVT is as close to a “free lunch” as policymakers could ever get. For this reason, I argue that it is simply irrational not to try and utilize LVT as much as possible.

Infrastructure

LVT also presents an incredible opportunity to sustainably fund public infrastructure. Today much of that infrastructure is funded through taxes on production and/or debt. A portion of your income tax, for example, might be used to fund an expressway project. However, due to the indirect nature of this financing, it’s difficult for taxpayers to see the connection between their hard-earned money and the facilities they use. This naturally makes raising funds for public infrastructure politically difficult, leaving it chronically underfunded and/or the government permanently indebted. On the other hand, those who benefit from an infrastructure project, such as a hotel located near an expressway exit, reap disproportionate benefits in the form of higher land values and better business opportunities.

Ideally, we want an infrastructure funding mechanism that doesn’t indebt the government (the public) and imposes the cost of financing upon those who benefit most. Traditionally, this has been attempted via “user fees,” tolls on roads, fares on subways and trains, or water/electricity usage fees. This makes sense, why not charge the people who use a road to help pay for its maintenance and recoup the construction costs? The problem is that user fees alone cannot fund infrastructure because the positive externalities of public infrastructure spill over onto land adjacent to it. This is where LVT becomes vital; an LVT captures those spillovers and returns the value created to the government (the public) that paid for it.

While not LVT per se, this is the basic concept employed by the Hong Kong Metro (MTR) system. The MTR is unique in that it is perhaps the only profitable underground transit system on Earth. The MTR employs a strategy called “Rail + Property.” The Metro partners with developers of land adjacent to their stations and depots. Since the presence of a metro station raises the value of the land nearby, the partnership allows the metro to capture some of this value by selling or leasing the property around the station. This works so well that not only is the MTR profitable, but it also charges significantly lower fares than similar systems in other cities. The MTR also requires no government subsidies. On the contrary, because the system is partly owned by the Hong Kong government, it pays the government hundreds of millions of dollars in dividends every year.

How Much Revenue Can LVT Raise?

Atax that can raise revenue without hurting the economy seems too good to be true. Purist advocates of LVT argue that we should set the tax rate at 100 percent to fully capture economic rents. To be clear, this is not a 100 percent tax on the land value (despite the name), but rather a 100 percent tax on the “rental value” of land. As a practical matter, I find this unworkable. As with property taxes, the science of valuation is fuzzy and imperfect. At a 100 percent rate, we risk unintentionally overshooting rent capture, causing harm. For this reason, striving for a 70-75 percent tax rate seems appropriate, but even 50 percent would be transformational. A lower rate could also reduce concerns about “searching costs” or the costs incurred by landowners in finding better uses for land. Some argue that a high LVT may disincentivize searching costs, slowing growth.

A 70 percent LVT could raise enough revenue to fund a large portion of government expenditures. More importantly though, because LVT engenders no deadweight loss, it can replace less efficient sources of revenue, such as income/corporate income taxes, accelerating overall economic growth and prosperity in the process. Indeed one 2002 study found that the elimination of taxes on production in the US could raise national output by some $1 Trillion a year. Interestingly, some of that increased wealth and output will raise the value of land and would be captured by the LVT.

Criticisms

Critics of LVT argue that it is unworkable in practice because it may be impossible to separate land rental value from the value of the improvements built upon it. Indeed this is a challenge, but perfect need not be the enemy of the good. So long as we allow for some margin of error, we can calculate land value with a “good enough” accuracy such that the tax can be collected and benefits reaped. This is precisely why I did not call for a 100 percent tax on land rents as this would leave no margin for error. How can we separate land value from the structure upon it? In areas with many vacant lots, this is simple. We can look at recent sales or conduct Vickrey auctions. This is a solid starting point because land values won't vary much from one parcel to the next.

In locales with little vacant land data to draw from, however, we need to get creative. For example, we could use a method known as abstraction, which takes the total market value of a property and subtracts the depreciated value of the improvements built upon it. This is easy because parcel market values are already calculated by property assessors and most structures are already fully insured. The Replacement Cost Value (RCV) and Actual Cash Value (RCV minus depreciation or ACV) of structures are already known to their insurers. Indeed, insurance companies have developed complex models to accurately estimate these figures. Once the ACV value is subtracted from the total market value, the difference is the approximate value of the land underneath the structure.

A third approach, known as allocation, determines the typical ratio of land to improvement values in a given area and assigns that ratio to similar properties. For example, property assessments may determine that land value is typically about 25 percent of the market value of properties in a city, thus a property worth $1 Million probably sits upon land worth about $250k. This ratio can vary wildly from one location to the next, of course, and thus this method should be used with great care.

The most accurate land value assessments, however, are likely to come from a blend of the above methods alongside what is known as the contribution value approach. This method utilizes multiple regression to identify the marginal contributions to market value made by various (sometimes 100+) property attributes. These traits could include access to sewage, electricity, roads, and proximity to parks, subway lines, fire stations, police stations, schools…etc. Using this methodology, computers and machine learning could rapidly mass-appraise land values in a particular jurisdiction. The contribution value approach is more likely to provide an accurate land value assessment because it divines the potential of land for uses beyond its current state.

I think it’s interesting that the contribution value approach reveals the virtuous cycle LVT seeks to foster. Because more tax revenue can be raised from valuable land parcels, governments will have a strong incentive to improve those market value drivers (building schools, improving transportation, curtailing crime…etc.) In other words, the people benefit when the government benefits. The corresponding increase in wealth drives up revenues that can be used to further improve the people’s welfare. This, in turn, drives up land values, increasing revenue…and so on. Going further, should the budget allow, we could redistribute surplus revenue in the form of a Negative Income Tax, UBI, or any other socially beneficial scheme we deem fit. Therein lies the beauty of LVT; it captures the bounty of Earth and humanity for the benefit of all, rather than the few. It correctly aligns the interests of the government with the governed and provides an opportunity to build a more just and inclusive society.

You Also May Like…

Where would the revenue come from to replace income tax with the LVT? Isn’t it just an unimproved property tax? In that case, wouldn’t taxpayers be paying less on the land they own or would this be on top of property taxes?

Interesting. I hadn't realized that the land tax meets all four criteria of Smith's good taxation policy.